Moody’s Investor Relations Material

Latest events

AGM 2024

Latest reports from Moody’s Corporation

Credit Rating Royalty

Moody's Corporation is a globally recognized financial services company with a primary focus on credit ratings, research, tools, and analysis for investors in debt markets. Today, Moody's Investors Service, its credit rating division, is among the "Big Three" credit rating agencies, alongside Standard & Poor's and Fitch Ratings. Its ratings have become instrumental for investors, lenders, and institutions looking to understand and mitigate financial risk. Besides credit ratings, Moody's Analytics, another segment of the company, provides financial intelligence and analytical tools to assist professionals in making informed decisions.

A Historic Institution

Moody's Corporation, a staple in the global finance sector, traces its origins to John Moody and the early 1900’s. Initially, the company began by producing manuals analyzing the details of stocks and bonds of railroads, an industry of enormous significance at the time. Over the decades, Moody's evolved to become one of the leading credit rating agencies, offering a comprehensive view of risk in various debt instruments. In the late 20th century, Moody's extended its services, delving into research, analytics, and data for investors. Today, its ratings and insights are deeply embedded in the global financial system, guiding investment decisions and providing a measure of trust for market participants worldwide.

Investor’s Services

Moody's Investors Service is the bond credit rating division of Moody's Corporation, its core and most longstanding business function. It rates include government, municipal, and corporate bonds, as well as investment vehicles like money market funds, fixed-income funds, and hedge funds. Moody's also assesses different financial institutions, including both traditional banks and other finance companies. Additionally, they rate certain structured finance asset categories. The aim of these ratings is to offer investors a straightforward tool to gauge the creditworthiness of various securities. Moody’s Investors Services is among the “Big Three” of credit rating agencies together with S&P and Fitch. The latter is not publicly traded,

Analytics

Moody's Analytics operates as a subsidiary of Moody's Corporation works outside of ratings and delivers both software solutions and advisory services. The department conducts in-depth economic research encompassing credit analysis, performance evaluation, financial modeling, structured analysis, and comprehensive risk management. Its offerings include unique economic models, specialized software tools, and expert-led training programs, primarily focusing on risk management proficiency within the financial industry. The analytics business arm has over 40.000 institutions as customers, with names like Tetragon and Barings being found on the list of clients.

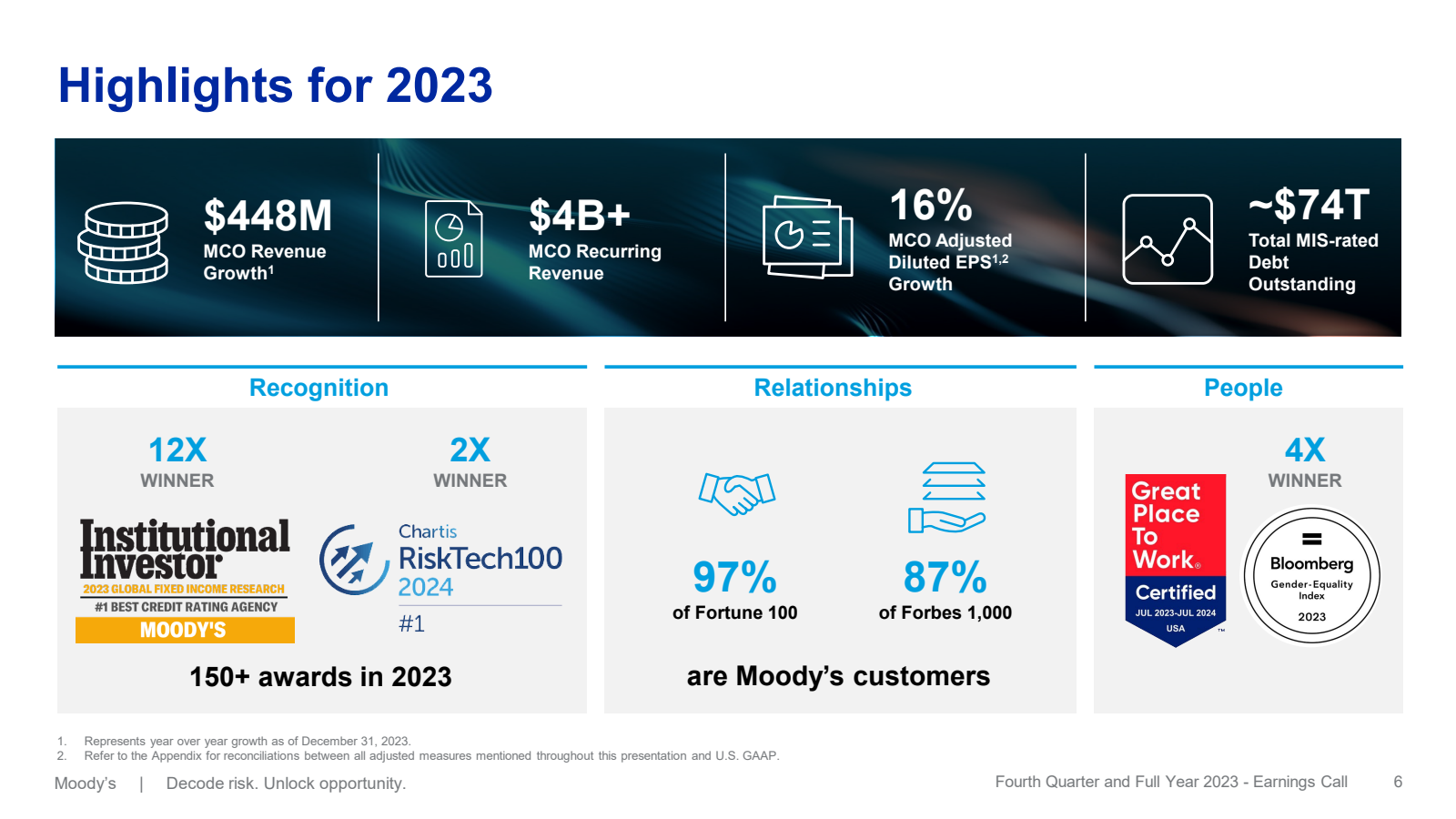

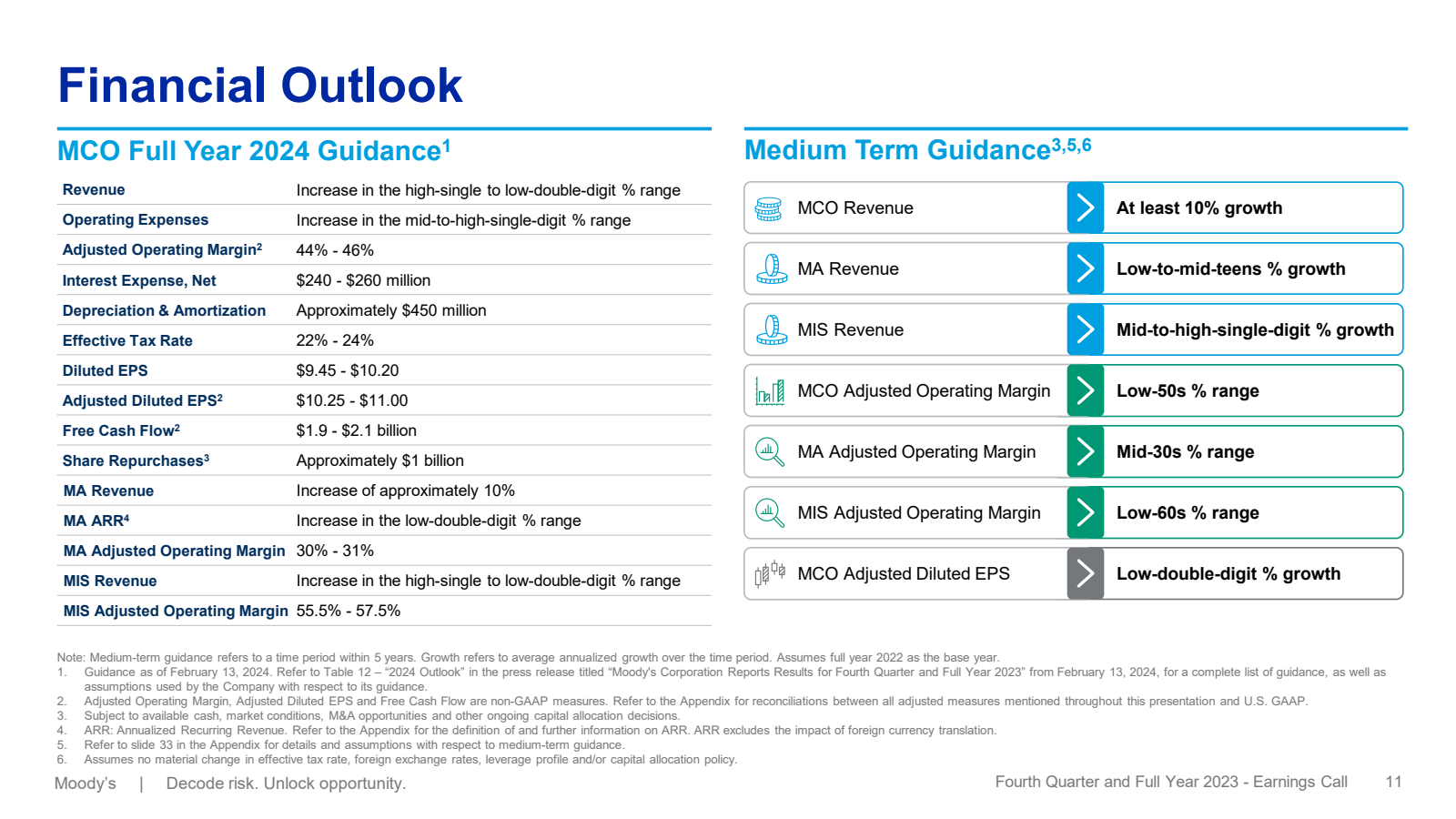

Key slides for Moody’s Corporation

Q4 2023

Q4 2023

Latest articles

Explore the journey of Larry Page from a tech-savvy youth to co-founding Google and leading Alphabet.

Information about Mark Leonard is scarce, and one of the only ways to “get to know” him is through his shareholder letters. Join us in an attempt to do so.