Interactive Brokers Group Investor Relations Material

Latest events

Q1 2025

Latest reports from Interactive Brokers Group Inc

A Brokerage for All Investors

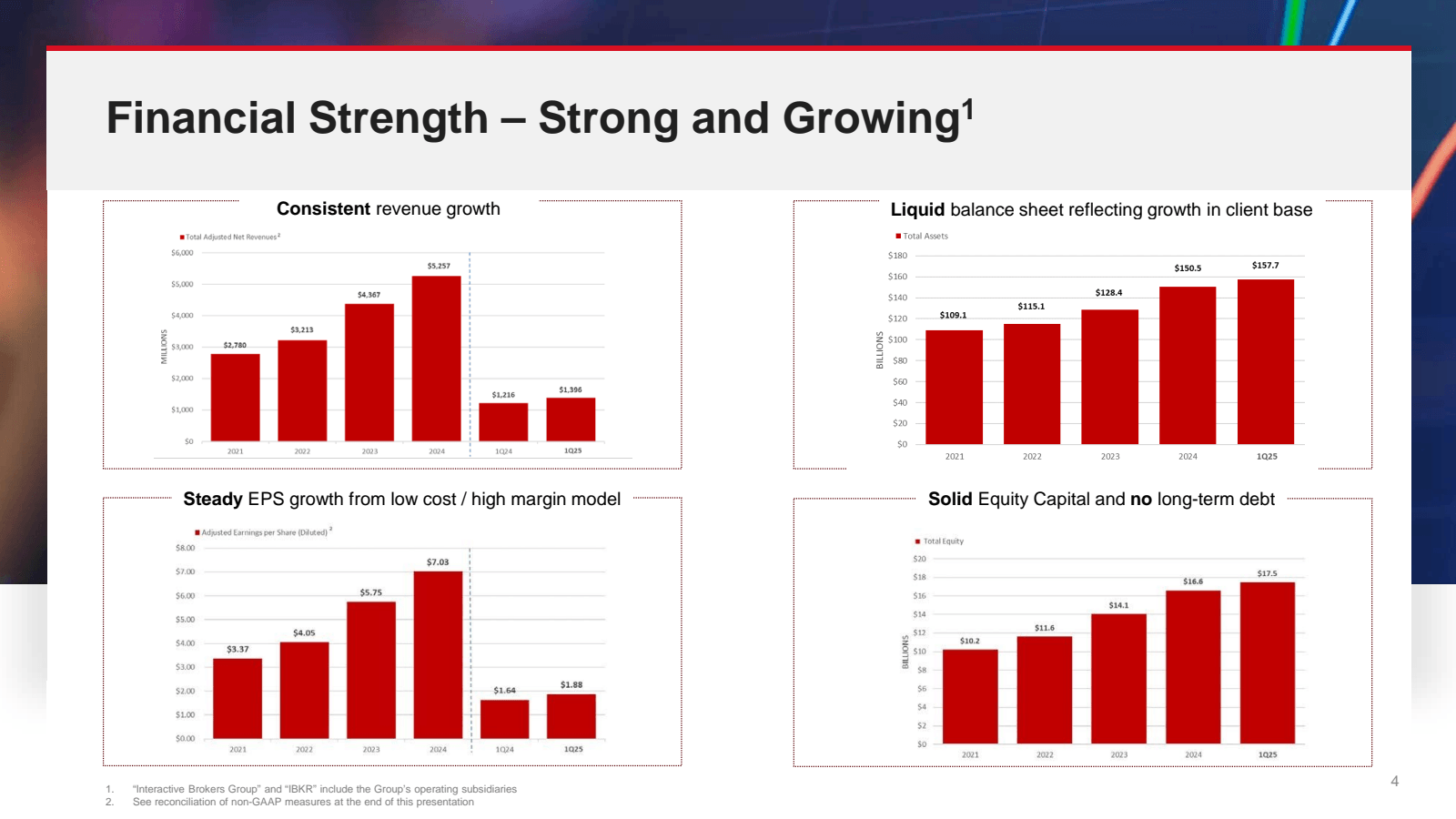

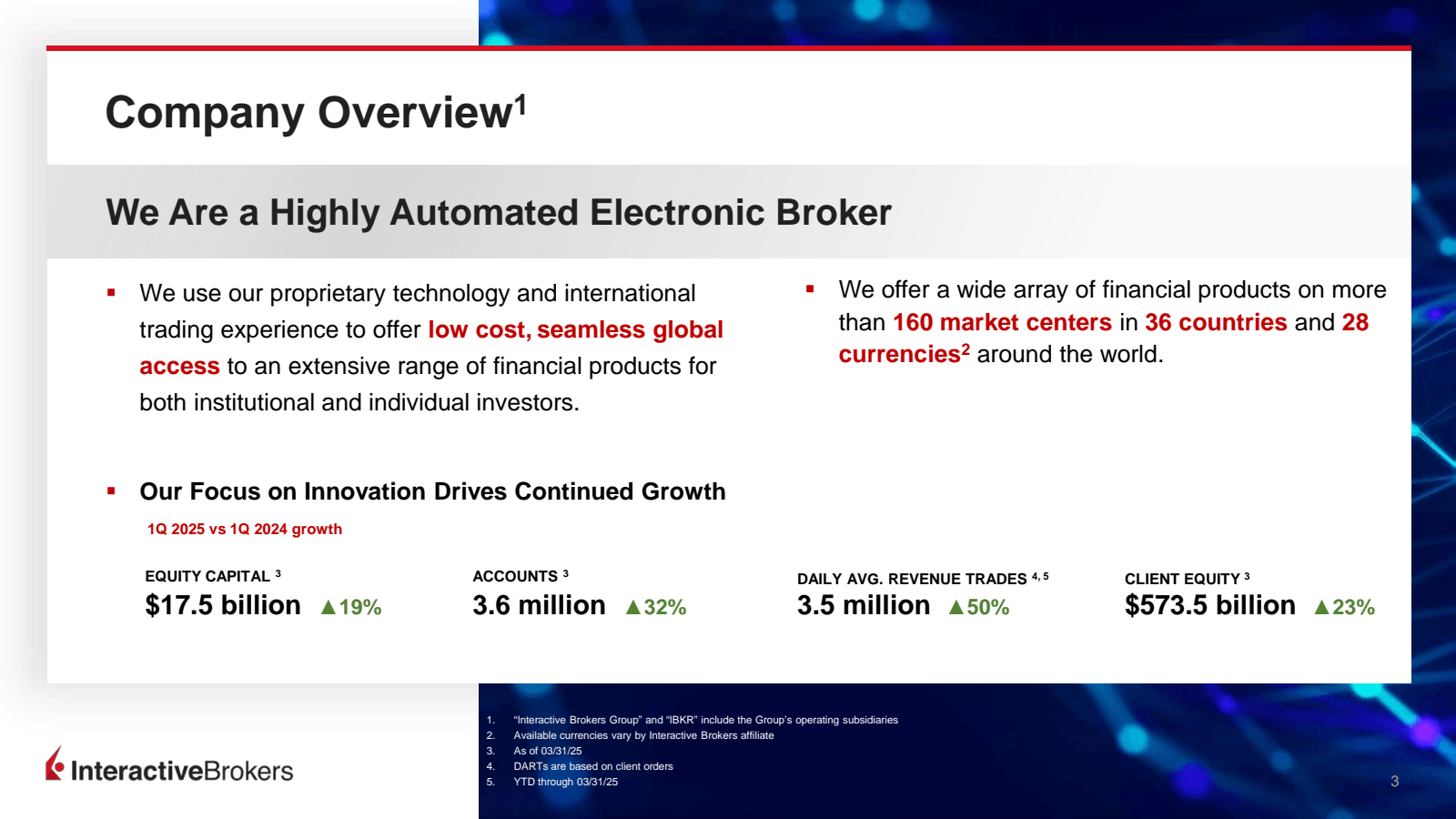

Interactive Brokers (IBKR) is a multinational brokerage firm established in 1978. With its origins in electronic trading, the firm has expanded to offer a wide range of financial services to individual and institutional clients around the world. Known for its advanced trading platforms, low-cost structure, and direct market access, IBKR caters to active traders, hedge funds, and professional investors. The platform provides access to over 125 market centers across 31 countries, making it a go-to for global trading. Furthermore, it offers stocks, options, futures, forex, and fixed-income products.

Origins as a Market Maker

Interactive Brokers (IBKR) was founded by Thomas Peterffy in 1978. Initially, the firm began its journey as a market maker, a crucial player that provides liquidity in financial markets. Peterffy was a pioneer in the early adoption of computerized trading, utilizing automated systems at a time when most trading was manually executed. By the mid-1980s, IBKR transitioned from trading on the floor to the screen, being one of the first to use computer-generated fair value sheets. Over the years, the firm shifted its focus from market-making to brokerage, capitalizing on its cutting-edge technology to offer advanced trading platforms. This transition allowed IBKR to serve a broader clientele, from individual traders to large institutions, giving them access to global markets at competitive rates.

Further reading: 5 Leading Online Brokers for Innovation

For Retail Investors

Interactive Brokers offers a comprehensive suite of services for retail investors. They provide access to a vast array of global markets, allowing clients to trade stocks, options, futures, forex, and bonds from a single platform. Their trading tools are powerful yet user-friendly and are usable by both novice and experienced traders and investors. One of their standout features is the low-cost trading with competitive commission rates. Additionally, they offer a robust research platform, a wealth of educational resources, and a mobile app. As many contemporary brokers do, the company also has robo-advisory services. Some of the company’s publicly traded peers include Charles Schwab, flatexDEGIRO, and Robinhood.

For Institutional Clients

Interactive Brokers provides a comprehensive suite of services tailored to meet the demands of institutional clients. Catering to hedge funds, financial institutions, and professional traders, their offerings include advanced trading platforms with high-speed execution and direct market access. Institutional clients can also benefit from prime brokerage services, which encompass securities lending, leveraged trade financing, and consolidated reporting. In addition, IBKR offers sophisticated API solutions for algorithmic trading and integration.

Key slides for Interactive Brokers Group Inc

Global Exchange and Trading Conference

)